Are you making the right choices with the money in your 401k?

Math based models to guide you in and out of the stock market.

We monitor and advise - you take action.

Simplify your 401(k) Investing with 4 Easy Steps.

How This Service Can Help You

Many of our clients and listeners are invested in their employer's 401(k) plan. In the past, it has been very difficult to provide timely information and suggestions for these types of accounts, because each one is unique.

We’re excited to say that Active401(k)™ changes that! We believe this new system can help meet a serious challenge for the average investor - how to make informed choices within the limits of their employer’s plan.

"The Average 401k Investor misses out on over $5,000 per year in investment gains due to poor timing and sub-par fund choices."

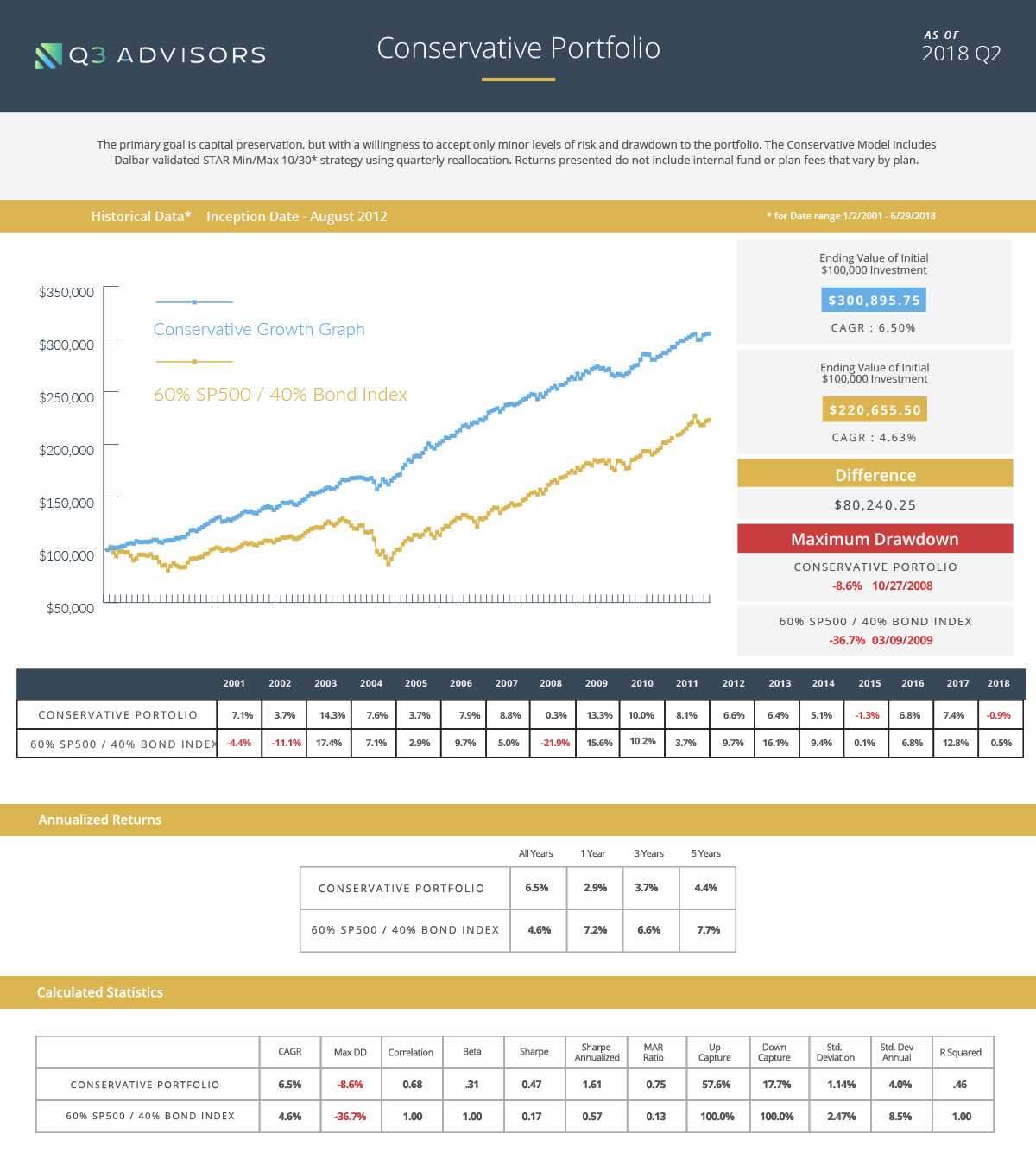

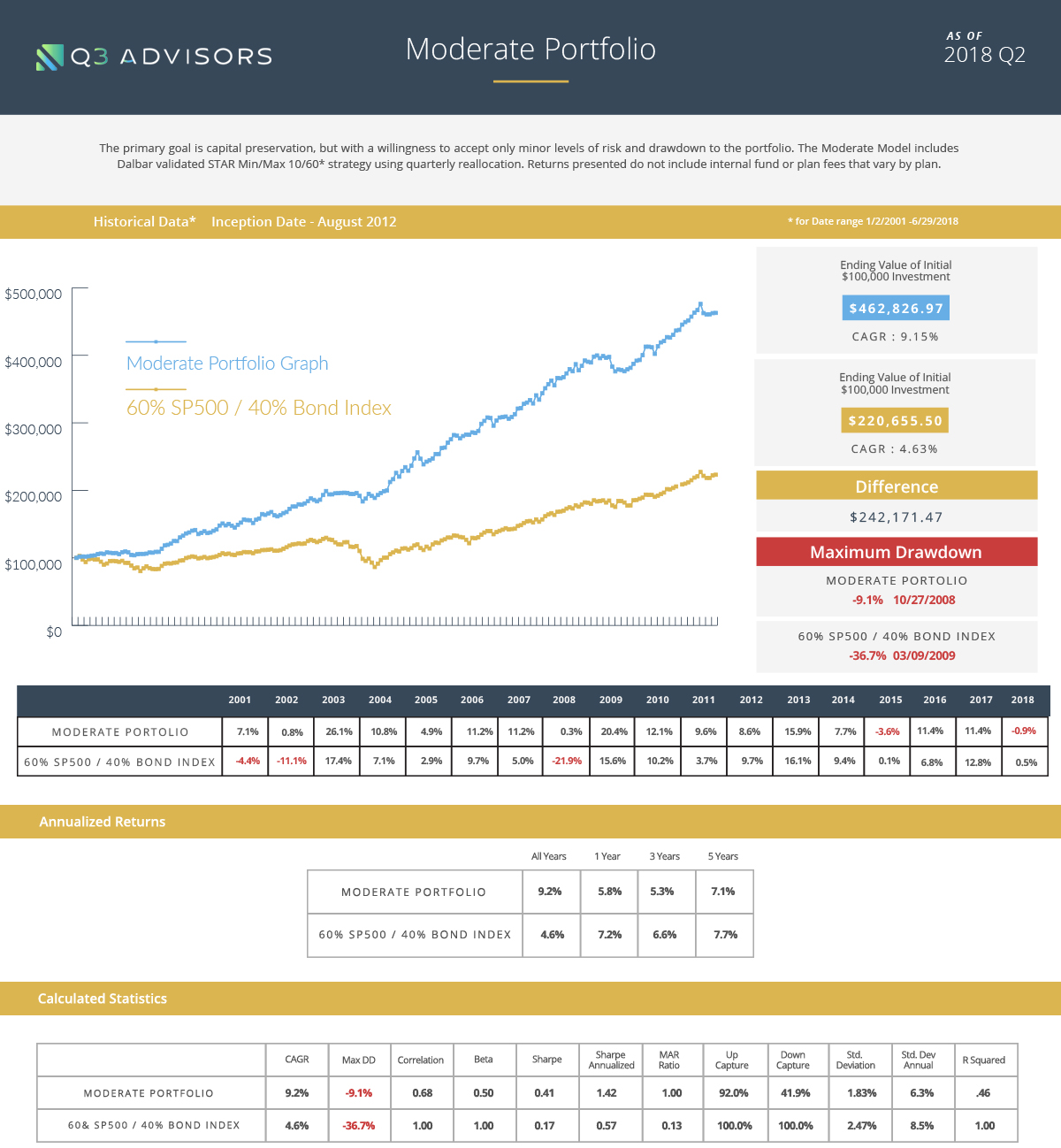

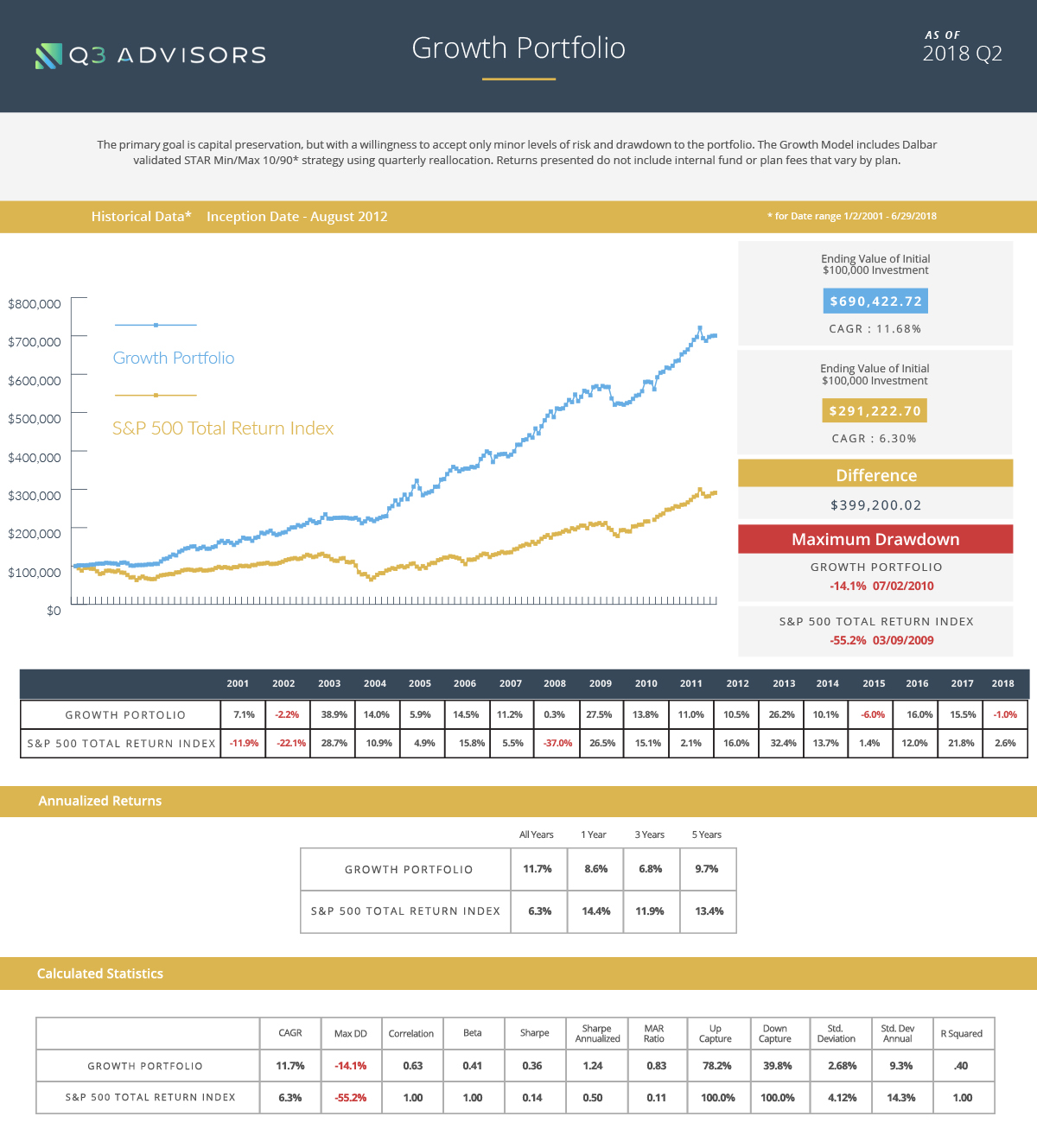

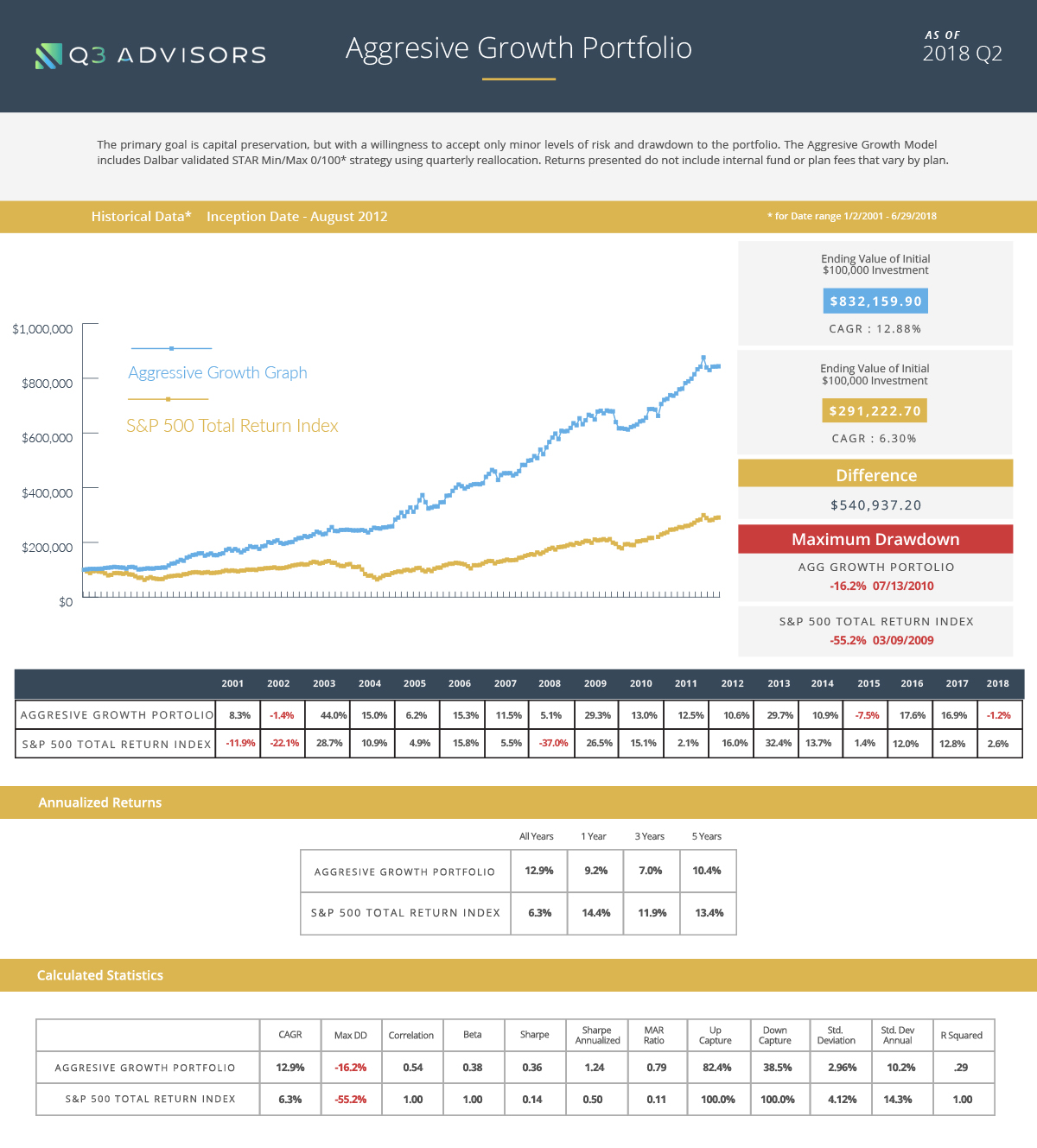

Historical Success

We don't know where the market will go- no one does. BUT the stock and bond markets constantly display identifiable trends. We capitalize on those trends to provide you with consistent account growth.

Pricing Structure

Monthly

- Receive Regular Allocation Recommendations

- Subscription to Weekly CMS Newsletter

Annually

- Receive Regular Allocation Recommendations

- Subscription to Weekly CMS Newsletter

- Free Monthly Retirement Whitepapers

- Premium Bi-Monthly Newsletter sent to your home

- Annual Support and Recommendations by Capital Management Services

Quarterly

- Receive Regular Allocation Recommendations

- Subscription to Weekly CMS Newsletter

- Free Monthly Retirement Whitepapers

90 Day

Free Trial

- Receive Regular Allocation Recommendations

- Subscription to Weekly CMS Newsletter

A study shows that more than 90% of your investment portfolio’s growth will be attributed to asset allocation. Yet less than 7% of 401k investors make changes to their investment allocations in a year.

Let Active 401k keep your asset allocation on track!

Any Questions?

We integrated the Grabel & Lytton risk tolerance questionnaire into our process to provide a starting point for you to better understand your own risk scores. Through a brief survey, the G&L questionnaire will accurately assess how much risk you are willing to take in the markets as well as how much return you're looking to receive on your investments. The G&L is the only peer-reviewed and tested risk tolerance work in the industry.

No. We never take custody of any of your funds. We simply provide solid advice as to where to invest it. We give you the suggested allocation and then you simply login to your custodians web portal and make the changes we suggest.

Our model portfolios use active strategies that constantly monitor the momentum and direction of stock and bond markets. While we also actively monitor the individual investment options inside of your retirement plan, we make recommendations for reallocation every calendar quarter. When there is a high probability of a downturn in the market over the coming quarter, we move to the minimum prescribed stock allocation for that quarter. When the probability for gains is indicated, we prescribe maximum stock allocation based on the risk portfolio that you select.

When it comes down to deciding which of your investment options to suggest, we always recommend the investment options that are currently showing the most sustainable momentum compared to the others. It's simply a mathematical interpretation of 'which of the options is currently offering the most potential for gain.

You cannot make changes to our model portfolios. You can change your profile with Active401k™to move to a more risky or less risky portfolio allocation. And of course, because you are in control of making the changes to your retirement account allocation (we just provide the information component) you can always choose to take more or less risk on their own.

Instead of the same old tired buy-n-hold investment strategies, ActivePortfolios provides an easy-to-explain tactical approach that can provide protection from normal market corrections while also participating in gains when they are available without undue risk.

Ready to Take The Next Step?

For more information about any of the products and services listed here, schedule a meeting today or register to attend a seminar.